Cloud-Based CRM for Global Insurance Enterprises

In today’s interconnected world, global insurance enterprises face unprecedented challenges. They operate across diverse markets, navigate complex regulatory landscapes, and cater to increasingly demanding customers. Traditional, on-premise Customer Relationship Management (CRM) systems often struggle to keep pace, leading to data silos, inefficient processes, and a fragmented customer experience. The answer for many lies in the cloud. Cloud-based CRM offers a scalable, flexible, and cost-effective solution to streamline operations, enhance customer engagement, and drive growth on a global scale.

This article explores the benefits of cloud-based CRM for global insurance enterprises, examining its key features, implementation considerations, and potential challenges. We’ll delve into how cloud CRM can help insurance companies manage customer data, automate workflows, personalize interactions, and gain valuable insights to improve decision-making. By understanding the power of cloud technology, insurance businesses can unlock new opportunities for growth and stay ahead in a competitive market.

Ultimately, the decision to adopt cloud-based CRM is a strategic one. It requires careful planning, a thorough understanding of business needs, and a commitment to change management. However, the potential rewards – improved efficiency, enhanced customer satisfaction, and increased profitability – make it a compelling investment for global insurance enterprises seeking to thrive in the digital age. This is not just about technology; it’s about transforming the way insurance companies connect with their customers and operate as a whole.

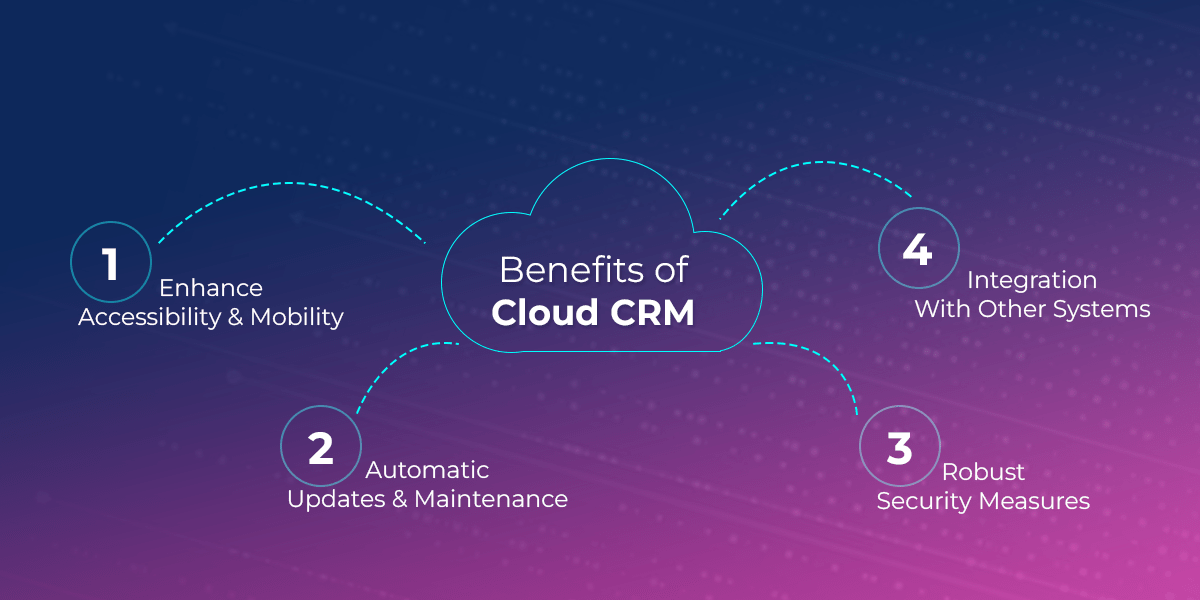

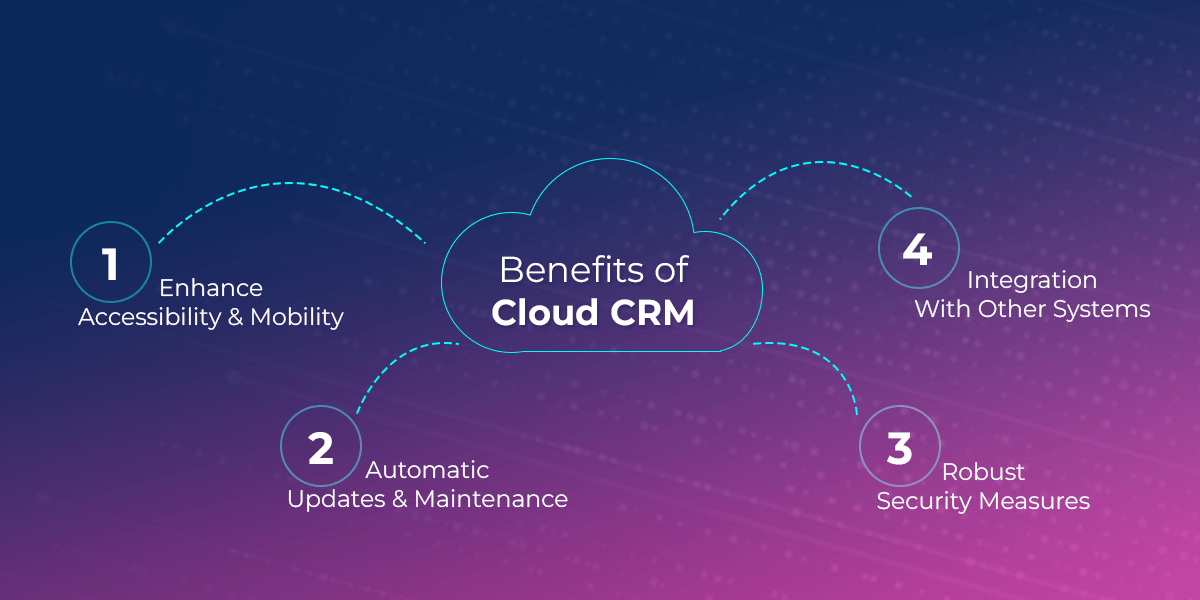

Understanding the Core Benefits of Cloud-Based CRM

Cloud-based CRM provides a multitude of advantages tailored to the specific needs of global insurance enterprises. Let’s explore some of the most significant benefits:. For companies seeking optimal efficiency, understanding Best Erp Systems is crucial for streamlining operations and maximizing profitability

Scalability and Flexibility

One of the most compelling advantages of cloud CRM is its inherent scalability. Global insurance companies often experience fluctuating demands based on seasonal trends, new product launches, or expansion into new markets. Cloud CRM allows them to easily scale their resources up or down as needed, without the need for significant upfront investments in hardware or infrastructure. This flexibility ensures that the system can always handle the current workload, providing a seamless experience for both employees and customers. Furthermore, cloud solutions adapt quicker to rapidly changing market conditions and evolving business strategies. If a new line of business is launched, the CRM can be configured to accommodate the new product offerings, customer segments, and associated workflows.

Cost-Effectiveness

Compared to traditional on-premise CRM systems, cloud-based solutions typically offer a lower total cost of ownership (TCO). The initial investment is significantly reduced as there is no need to purchase expensive hardware or software licenses. Instead, companies pay a subscription fee based on their usage, which can be more predictable and manageable. Moreover, cloud CRM eliminates the need for in-house IT staff to maintain and support the system, further reducing operational costs. Updates and maintenance are handled by the cloud provider, freeing up internal resources to focus on core business activities. The cost savings can be substantial, allowing insurance companies to allocate resources to other strategic initiatives, such as product development or marketing campaigns.

Enhanced Collaboration and Accessibility

Cloud CRM fosters better collaboration among geographically dispersed teams. With a centralized platform accessible from anywhere with an internet connection, employees can easily share information, collaborate on projects, and provide consistent service to customers regardless of their location. This is particularly important for global insurance companies with offices and agents around the world. Sales teams can access customer data on the go, underwriters can review applications remotely, and claims adjusters can update records in real-time. This improved accessibility streamlines workflows, reduces delays, and enhances overall productivity. Furthermore, cloud-based CRM facilitates seamless integration with other business systems, such as accounting software and marketing automation platforms, creating a unified view of the customer across the entire organization.

Improved Data Security and Compliance

While some businesses may initially be concerned about data security in the cloud, reputable cloud CRM providers invest heavily in security measures to protect their customers’ data. They employ advanced encryption technologies, implement strict access controls, and undergo regular security audits to ensure compliance with industry regulations, such as GDPR and HIPAA. In many cases, cloud providers can offer a higher level of security than insurance companies could achieve on their own, due to the specialized expertise and resources they dedicate to data protection. Moreover, cloud CRM can help insurance companies comply with regulatory requirements by providing audit trails, data retention policies, and other features that ensure data integrity and accountability. Data loss prevention (DLP) features can also be implemented to further protect sensitive information.

Real-Time Insights and Analytics

Cloud CRM provides powerful analytics capabilities that enable insurance companies to gain valuable insights into their customers, products, and operations. By tracking key metrics such as customer acquisition cost, policy renewal rates, and claims processing times, companies can identify trends, optimize processes, and make data-driven decisions. Real-time dashboards provide a visual representation of key performance indicators (KPIs), allowing managers to monitor performance and identify areas for improvement. These insights can be used to personalize marketing campaigns, improve customer service, and develop new products and services that meet the evolving needs of the market. For instance, analyzing customer data can reveal unmet needs that can be addressed by creating new insurance products or tailoring existing offerings.

Key Features to Look for in a Cloud-Based CRM for Insurance

When selecting a cloud-based CRM for a global insurance enterprise, it’s crucial to consider the specific features that will best support the company’s unique needs. Here are some essential features to look for:

Policy Management

The CRM should provide a comprehensive view of all customer policies, including policy details, coverage amounts, premiums, and renewal dates. It should also facilitate policy creation, modification, and cancellation, streamlining the policy lifecycle management process. The ability to integrate with policy administration systems is vital for efficient data synchronization.

Claims Management

An integrated claims management module is essential for tracking claims from initiation to resolution. The system should allow customers to submit claims online, track their status, and communicate with claims adjusters. Automated workflows can streamline the claims process, reducing processing times and improving customer satisfaction. Features like fraud detection and automated document processing are also highly beneficial.

Lead Management and Sales Automation

The CRM should provide tools for managing leads, tracking sales opportunities, and automating sales processes. This includes features such as lead scoring, email marketing, and sales forecasting. Sales automation can help insurance agents focus on building relationships with customers and closing deals, rather than spending time on administrative tasks. Integration with marketing automation platforms is essential for generating and nurturing leads.

Customer Service and Support

The CRM should provide a centralized platform for managing customer interactions across all channels, including phone, email, chat, and social media. Features such as case management, knowledge base, and self-service portals can empower customers to resolve issues on their own, reducing the burden on customer service agents. Sentiment analysis can help identify and address customer concerns proactively.

Regulatory Compliance

The CRM should be compliant with relevant industry regulations, such as GDPR, HIPAA, and local data privacy laws. It should provide features for managing data consent, ensuring data security, and maintaining audit trails. The ability to generate reports for regulatory compliance purposes is also important.

Reporting and Analytics

The CRM should provide robust reporting and analytics capabilities that enable insurance companies to track key performance indicators (KPIs) and gain insights into their business. This includes features such as custom dashboards, ad-hoc reporting, and predictive analytics. The ability to integrate with business intelligence (BI) tools is also beneficial.

Implementation Considerations and Potential Challenges

Implementing a cloud-based CRM system is a complex undertaking that requires careful planning and execution. Here are some key considerations and potential challenges to be aware of:

Data Migration

Migrating data from legacy systems to the cloud CRM can be a significant challenge. It’s important to ensure that data is clean, accurate, and properly formatted before migrating it to the new system. Data mapping and transformation may be required to ensure compatibility. A well-defined data migration plan is crucial for minimizing disruption and ensuring a smooth transition.

Integration with Existing Systems

Integrating the cloud CRM with other business systems, such as policy administration systems, claims management systems, and accounting software, is essential for creating a unified view of the customer. This requires careful planning and coordination to ensure that data flows seamlessly between systems. APIs and web services can facilitate integration, but custom development may be required in some cases.

User Training and Adoption

Successful CRM implementation depends on user adoption. It’s important to provide adequate training to employees on how to use the new system and to communicate the benefits of the CRM to encourage adoption. A well-designed training program can help users become proficient in using the CRM and maximize its value. Implementing Crm Software Insurance can streamline client management and improve policy sales

Change Management

Implementing a cloud-based CRM can require significant changes to business processes. It’s important to manage these changes effectively to minimize disruption and ensure that employees are comfortable with the new way of working. A well-defined change management plan can help to address resistance to change and ensure a smooth transition.

Security and Compliance

Ensuring the security and compliance of data in the cloud is a critical consideration. It’s important to choose a cloud CRM provider that has robust security measures in place and is compliant with relevant industry regulations. Data encryption, access controls, and regular security audits are essential for protecting sensitive data.

Choosing the Right Cloud-Based CRM for Your Enterprise

Selecting the right cloud-based CRM is a critical decision. Consider these factors:

- Business Requirements: Clearly define your business needs and prioritize the features that are most important to your organization.

- Scalability: Ensure that the CRM can scale to meet your future needs as your business grows.

- Integration Capabilities: Verify that the CRM can integrate with your existing systems.

- Security: Evaluate the security measures implemented by the CRM provider.

- Vendor Reputation: Research the vendor’s reputation and track record.

- Pricing: Compare the pricing models of different CRM providers.

- Customer Support: Evaluate the level of customer support offered by the CRM provider.

By carefully considering these factors, global insurance enterprises can select a cloud-based CRM solution that meets their specific needs and helps them achieve their business goals.

Frequently Asked Questions (FAQ) about Cloud-Based CRM for Global Insurance Enterprises

How can a cloud-based CRM system help a global insurance enterprise improve customer relationship management and policyholder retention?

A cloud-based CRM system offers several advantages for global insurance enterprises seeking to enhance customer relationship management and improve policyholder retention. Firstly, it provides a centralized, accessible platform for managing customer data, enabling a 360-degree view of each policyholder across all departments and geographical locations. This unified view facilitates personalized communication and targeted marketing campaigns, improving customer engagement. Secondly, cloud-based CRMs offer scalability and flexibility, allowing the system to adapt to the evolving needs of a growing global enterprise. Thirdly, automated workflows and reminders ensure timely follow-ups and proactive customer service, boosting customer satisfaction and loyalty. Finally, advanced analytics capabilities provide insights into customer behavior and preferences, enabling insurers to identify at-risk policyholders and implement retention strategies effectively. By leveraging these features, global insurance companies can significantly improve customer relationships and reduce churn. Understanding the complexities of Erp Implementation Guide is crucial for a smooth project lifecycle

What are the key security considerations when implementing a cloud-based CRM solution for a global insurance company handling sensitive customer data?

Implementing a cloud-based CRM solution requires careful consideration of security, especially for global insurance companies handling sensitive customer data. Data encryption, both in transit and at rest, is paramount. Look for CRMs that comply with industry-standard encryption protocols (e.g., AES-256). Access control and authentication are also crucial; implement strong password policies, multi-factor authentication (MFA), and role-based access controls to limit access to sensitive information. Ensure the CRM provider has robust data loss prevention (DLP) mechanisms to prevent unauthorized data exfiltration. Regular security audits and penetration testing should be conducted by both the insurance company and the CRM provider to identify and address vulnerabilities. Compliance with relevant data privacy regulations, such as GDPR and HIPAA, is essential. Finally, establish a comprehensive incident response plan to address potential security breaches promptly and effectively. Data security should be a top priority when selecting a cloud-based CRM.

How does integrating a cloud-based CRM with existing legacy systems, such as policy administration and claims management platforms, benefit a global insurance provider?

Integrating a cloud-based CRM with existing legacy systems offers significant benefits for global insurance providers. By connecting the CRM with policy administration and claims management platforms, insurers can achieve a unified view of customer interactions and policy information. This integration eliminates data silos, streamlines workflows, and improves operational efficiency. For instance, customer service representatives can access policy details and claims history directly from the CRM, enabling them to provide faster and more informed support. Marketing teams can leverage policy and claims data to create targeted campaigns and personalized offers. Furthermore, integration facilitates data-driven decision-making by providing a comprehensive view of the customer lifecycle. It improves cross-selling and up-selling opportunities by identifying customers who may benefit from additional insurance products. Ultimately, CRM integration empowers global insurance providers to deliver a superior customer experience, increase revenue, and reduce operational costs.